[ad_1]

Hi! I’m Charis, and I paid off $46,500 of debt in two years.

Charis Barg

I did this by first accepting that I wanted to be serious about paying down debt quickly. Then, I started to keep track of my spending and budgeted more consistently. What helped me a lot was budgeting in a way that was simple and worked for me, even though I knew it wasn’t perfect.

While I’d consider myself pretty good with money now, I haven’t always been financially savvy. Here are the biggest money mistakes I’ve made throughout my life, so hopefully you can avoid making them, too!

1.

Not checking how much money I owed on credit cards.

Charis Barg

I had an “out of sight, out of mind” view of money. I’d be too scared to see the damage of how much I’d spent on my credit cards, and I never wanted to check how much was in my bank account. Once I finally looked, I realized knowing the exact numbers — even if they weren’t great — made me feel better than the anxiety of not knowing at all.

2.

I didn’t have autopay setup for my debt, so I was late on a few monthly payments.

iHeart Radio MMVA / Via Giphy / giphy.com

I knew nothing about building credit or being financially responsible, so I didn’t see the importance of making my payments by the due date. I ended up being late on a few car payments. Sadly, those marks are on my mom’s credit report, since she signed for my car. Truly devastating. I still feel bad.

3.

Not knowing what the heck a credit score is.

Experian

When I decided to pay down my debt, I remember checking my credit score and having no clue what the numbers meant. After some googling, I used Experian to keep track of my score, and I eventually raised it a few hundred points by paying down my debt (on time). YAY!

Experian

When I decided to pay down my debt, I remember checking my credit score and having no clue what the numbers meant. After some googling, I used Experian to keep track of my score, and I eventually raised it a few hundred points by paying down my debt (on time). YAY!

4.

Thinking a car magically takes care of itself.

Charis Barg

I totally didn’t realize how many car-related expenses there would be — and how fast they’d add up. Did you know you have to renew your car registration every year? I didn’t! I ended up having to pay a ticket for expired tabs, the actual cost of registration, plus late fees on top of all that. Ugh.

What stressed me out most about owning a car was when unexpected things happened. I’d go to the mechanic for a simple oil change, and it’d turn out I also needed new tires. Suddenly I’d spent $200 I hadn’t planned for.

Now I’m an ~experienced~ car owner, I know to set aside some emergency money for my car every year, just in case.

5.

I racked up debt without a plan to pay it all off.

Charis Barg

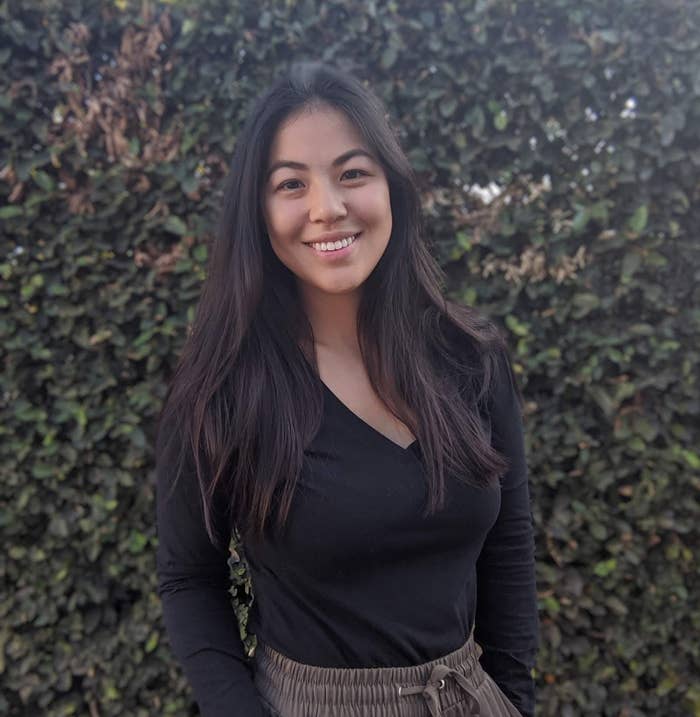

I had student loans, credit cards, and a car loan accruing interest without any idea how I’d pay it all off. When I finally decided to tackle it, I ended up doing a mix of two methods: debt snowball (paying off debt from the lowest amount owed to highest) and debt avalanche (paying off debt with the highest interest rate first).

Using undebt.it was a great way to keep track of debt payments, and I found it super motivating.

6.

Buying way too many clothes just because they were on sale.

Buena Vista Pictures / Via Giphy / media.giphy.com

I’d literally see a sale at the mall for a shirt similar to three I already owned, and I’d buy it just because it was 50% off. The issue was I did this All. The. Time. I had a closet full of clothes I didn’t even like, and I’d hate to think how many shirts I bought on sale only for them to eventually be donated with the tags still on.

7.

Swiping my card without thinking about it.

Little Tikes / Via Giphy / giphy.com

I could buy a $5 coffee, grab a $10 sandwich combo for lunch, get a $20 sweatshirt while passing a store (they’re having a sale so obviously I need one), then spend $50 going out for dinner and drinks with friends, all while complaining that I was ~so broke~.

Once I started tracking my expenses, I realized how much money I wasted on random crap.

8.

Not investing early with my spare change.

Acorns / Via Acorns / dropbox.com

I always thought I’d need to know as much as a Wall Street banker before I could start investing. I would’ve started years earlier if I knew about Acorns, an app that automatically invests for you. I love it because it invests by rounding up my regular purchases to the nearest dollar. SO EASY.

9.

I wouldn’t budget unless I could make it perfect.

View this photo on Instagram

Charis Barg / Via Instagram / instagram.com

I thought if I couldn’t make my budget perfect, I might as well not even try. The issue is that trying to make a perfect budget is borderline impossible, so I’d get overwhelmed and quit. Now I just use trusty Excel, and while it’s not flawless, it’s one I’ve sustained and used for years. <3

10.

Overpaying my taxes because I didn’t know what I was doing.

Comedy Central / Via Giphy / giphy.com

OMG, don’t get me started on taxes.

Storytime: I moved to a different state in the middle of the year so I had no idea what to do with two W-2s for different states. I tried my best, but ended up having to pay back $900 in taxes. I later learned that I did it wrong and was double taxed by both states instead of individually. Ugh.

Now I just use TurboTax since I can just upload my tax forms, and then they pretty much handle the rest.

11.

Living paycheck to paycheck without trying to save money.

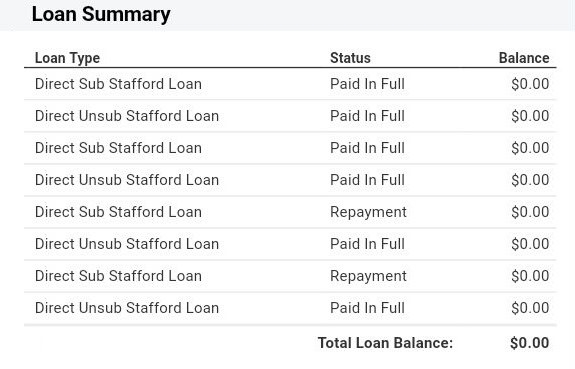

Qapital / Via Qapital Products / qapital.com

If $200 came into my bank account, I’d spend $200 instead of trying to save it or pay off any debt. I struggled to get motivated to save money just for the sake of it, but I’ve found it helps to have something to save for. I like using Qapital because it lets me set a savings goal and links directly to my bank account. You get to set different savings “rules,” which makes it kinda fun, and the app automatically puts money towards your goals.

I find it way better to visually see money being saved for exciting things, because saving money for a trip to Bali? AWESOME. Saving money because I should? Boring and doesn’t motivate me.

12.

Giving in to impulse buys too often.

Caffeine Studios / Via Giphy / giphy.com

Let’s be honest: who doesn’t like getting shiny new things? I used to have absolutely no impulse control. If I got the urge to pick up drawing as a hobby, I immediately bought a drawing book, fancy pencils, and paint, only to draw once and never touch it again.

Nowadays, I try to wait a few days or a week before buying things. If I see something I want, I bookmark it and look back on it later. Waiting gives me a chance to re-evaluate my impulses and I normally end up deciding I don’t need it.

13.

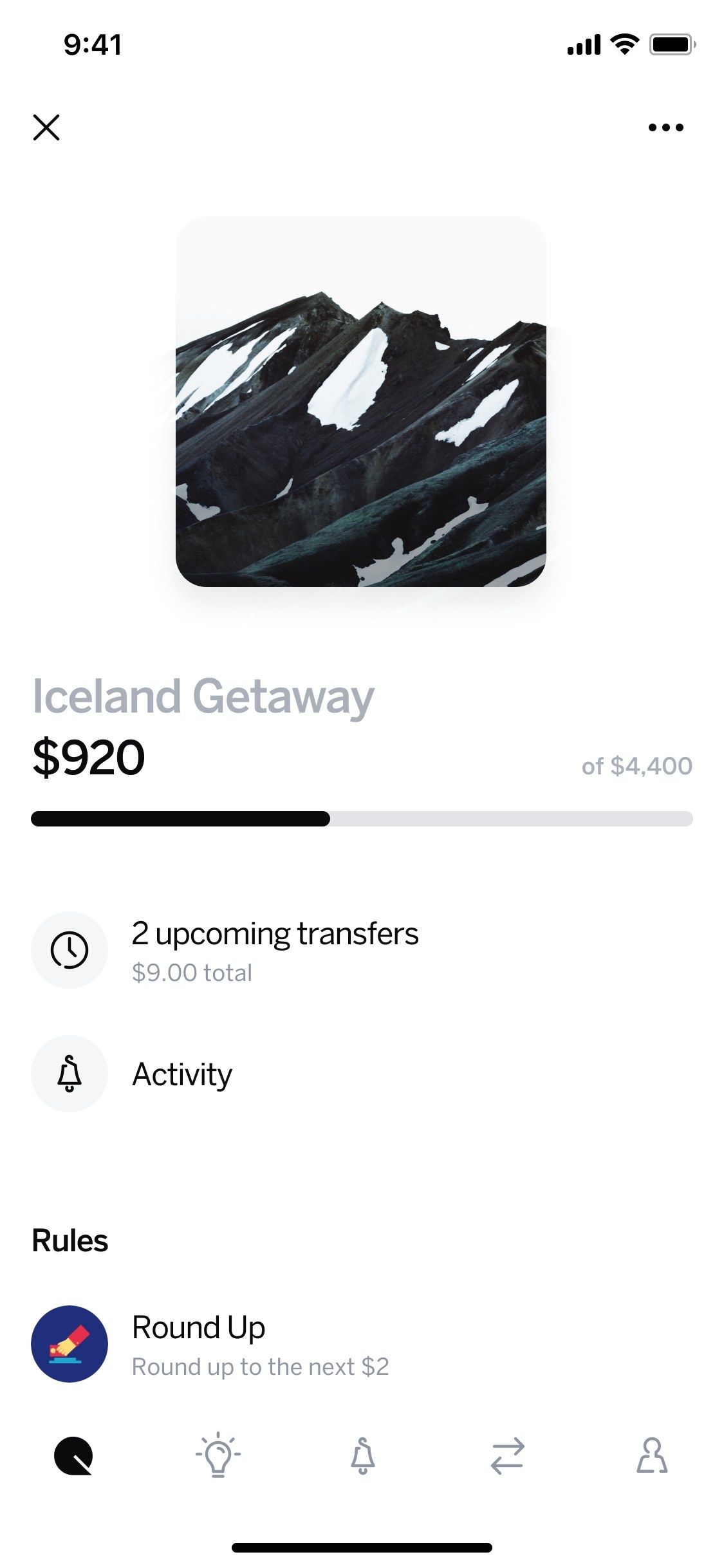

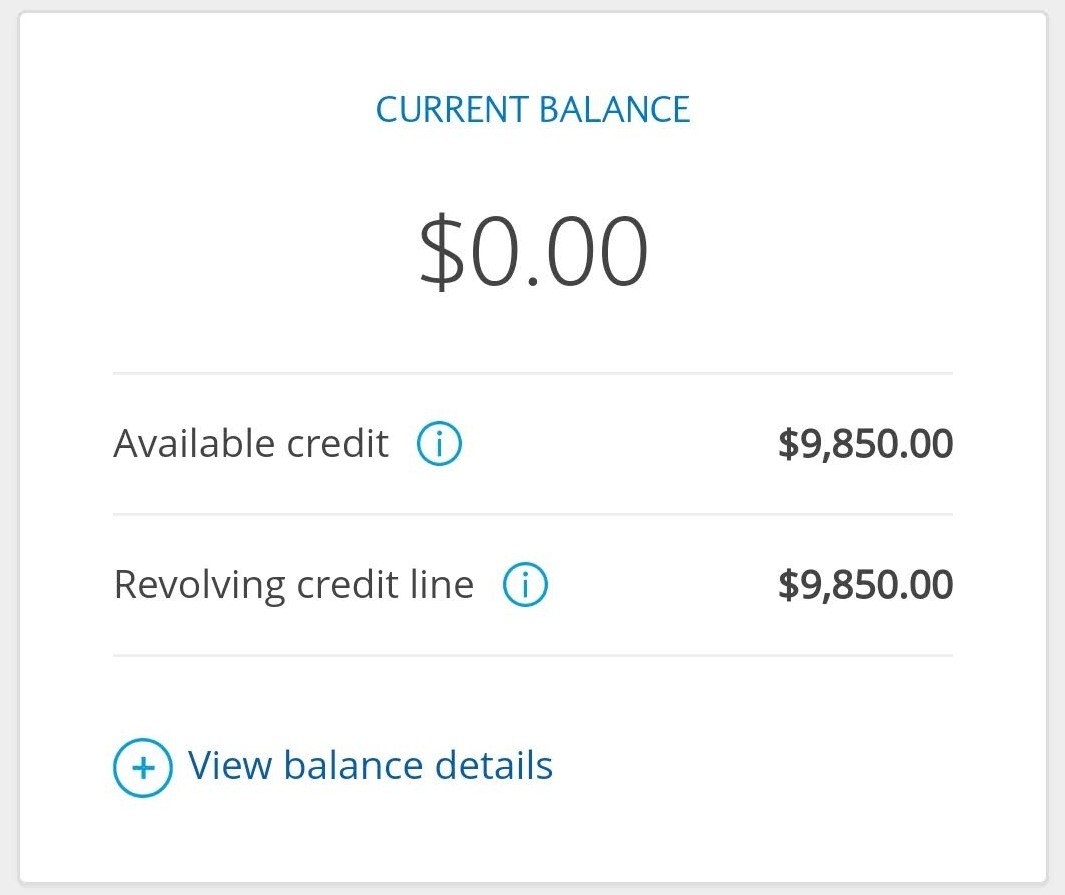

I thought my credit line limit = free money.

Charis Barg

My first credit card had a credit limit of $6,000. Unfortunately, I saw this to mean I had $6,000 to spend. Spoiler: I didn’t. And then I had to pay it back. With interest.

14.

Spending more than I wanted to on delivery and eating out.

FOX / Via Giphy / giphy.com

I never kept track of how much I was spending on food, but it would have easily been over $300 a month. But the thing is: I wasn’t even going to fun restaurants — I was spending it on fast food or takeout that I didn’t even really enjoy.

It’s annoying to think back on now, because I remember wanting to go on a trip to Iceland but “I couldn’t afford it.” In hindsight, I know if I’d just not gone out to eat so much, I totally could have gone on that trip.

15.

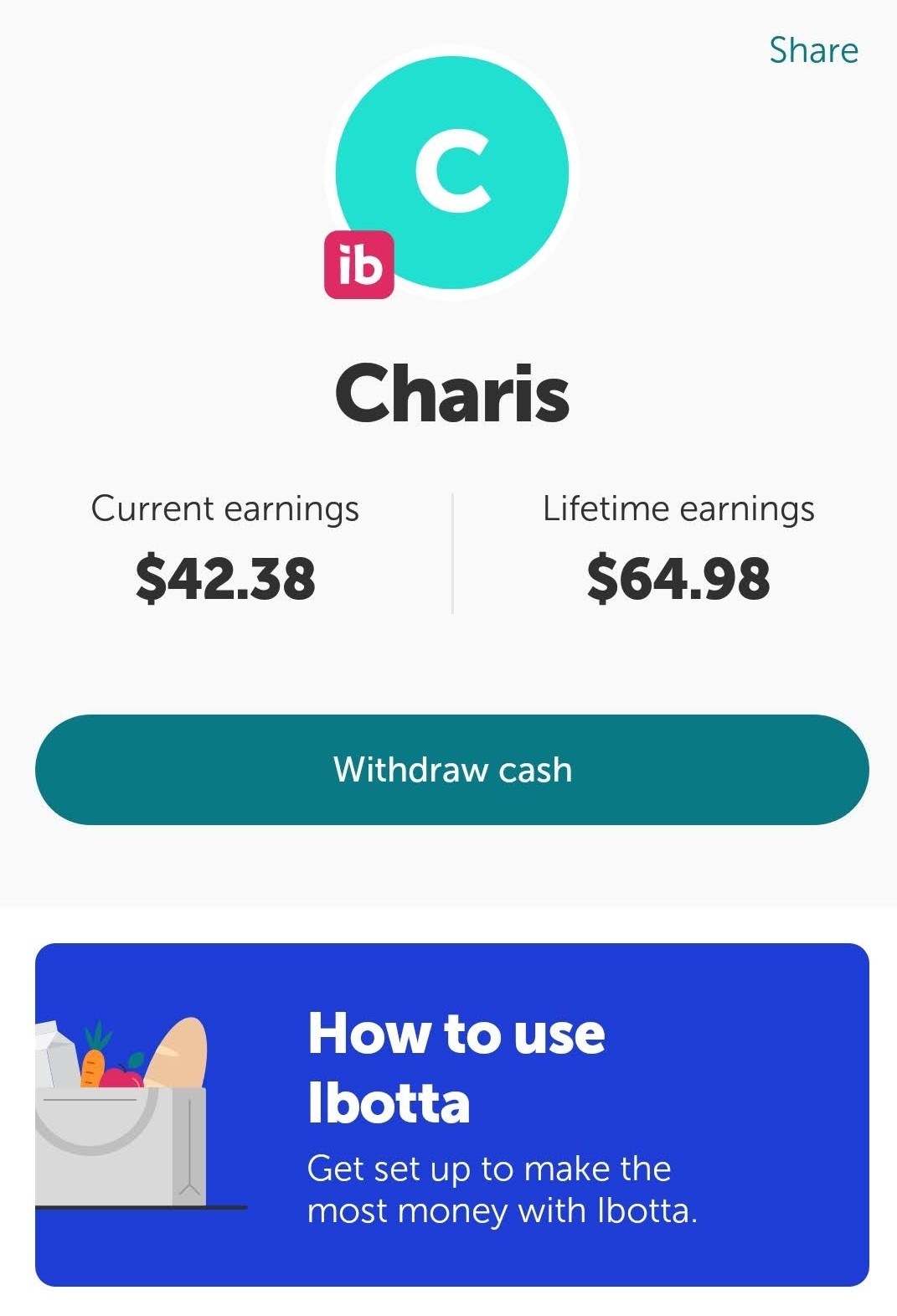

Overspending by not looking for cheap deals.

Charis Barg

I used to go shopping without even thinking about deals. If I wanted a new coffee machine, I’d go to Target and buy the first one I saw. If I wanted to go see a show, I’d buy tickets directly from the event website instead of searching around for discounted rates.

Now I know better. I like using cashback apps like Ibotta to get money back when I buy things. I especially love using it for Amazon purchases, since I feel like I’m singlehandedly paying Jeff Bezos’s income. Before I go ahead and buy brand new items, I scour Craigslist or OfferUp to see if I can find what I need secondhand. And I’ll always check Groupon for local deals — I once paid $40 to go to an event where the posted price was over $200!

16.

Trying to live like others.

View this photo on Instagram

@kyliejenner / Via Instagram / instagram.com

I made the classic mistake of trying to keep up with The Joneses. If my friends bought a new phone, I wanted one too. If I saw an outfit I liked, I went out to buy it that day.

It’s actually surprisingly expensive to impress people you don’t know or even like.

17.

Not evaluating if I’d really use the things I was spending my money on.

Jenna Marbles / Via Giphy / giphy.com

Ok, I don’t just mean small purchases like whether I really needed to buy a blender. I also mean huge expenses like, oh I dunno, A COLLEGE DEGREE? I had no idea how much my tuition would cost until after I graduated and had to pay down the loans. Thinking back, I wish I had done more research on cheaper schools.

After all, I studied to be a nurse and now I’m a writer. ¯_(ツ)_/¯

If this sounds like music to your ears (and bank account), check out more of our personal finance posts.

[ad_2]

Source link