[ad_1]

We hope you love the products and services we recommend! All of them were independently selected by our editors. Just so you know, BuzzFeed may collect a share of sales or other compensation from the links on this page. Oh, and FYI — prices and rates are accurate as of time of publication.

Going to college is a huuuge milestone (and accomplishment). But it’s no secret that the cost of an education can sometimes leave a bad taste in students’ mouths — and we’re not just talking about tuition.

Netflix / Via giphy.com

As a student, it can feel like every time you turn around, you have to pay for a stack of textbooks, new software, or something for your dorm room. Luckily, there are some pretty handy ways you can save while you study.

1.

Open up a high-yield savings account.

NBC / Via giphy.com

Consider putting any extra cash that you can into a high-yield savings account (HYSA). This allows you to grow your money even if you aren’t regularly contributing to your account (thanks to the power of compound interest over time). Regular savings accounts offer you interest rates that are way lower than the national average. Basically, you’re earning literal pennies as a “thank you” for keeping your hard-earned money in that account.

Some banks offer high-yield savings accounts, which can earn you more than the national average interest rate. Just keep in mind these rates can vary since the interest rates set by the Federal Reserve change.

When looking for a good high-yield option, you might consider online banks. They usually offer higher interest rates than brick-and-mortar banks because they typically have fewer overhead expenses. Ally Bank and Marcus by Goldman Sachs currently offer 0.5% (that’s 10 times the average, BTW) on their online savings accounts.

2.

Rent online textbooks through VitalSource for a fraction of the cost of buying them.

FOX / Via giphy.com

Hopefully you’re already well-acquainted with Chegg, which helps you rent and buy textbooks at lower prices. But VitalSource is a hidden gem for affordably renting online textbooks. Their digital texts can wind up costing you 80% less than renting other e-textbooks — seriously, I needed to buy a textbook for grad school that cost over $80 on other sites; I rented the online version from VitalSource for just $25!!!

And, VitalSource lets you read the book almost as if you had it right in front of you. It has an annotation feature where you can jot down notes on the side (which made reviewing for my exam basically effortless). And, you can virtually highlight important info as you read.

3.

And buy from the campus bookstore as an absolute last resort, only if you’re in a pinch for something you reaaally need.

Enes Evren / Getty Images / Via gettyimages.com

The campus bookstore can really come in clutch when you’re on your way to your calculus midterm and your graphing calculator runs out of battery. Or, when you reaaally need a tampon or an ibuprofen and don’t have time to run back home to get one before your next class. But things often cost more here than they would at an off-campus store. Try to avoid having to make too many purchases at your school’s bookstore, unless you really have no other choice.

4.

Start paying off your student loans while you’re still in college — this can help you avoid racking up interest charges.

Catherine Mcqueen / Getty Images / Via gettyimages.com

When you take out subsidized federal student loans, you won’t have to start making payments until after the six-month grace period post-graduation. After this period, your balance starts accruing interest and you’ll be expected to make monthly payments. But that doesn’t mean that you have to wait until you complete your degree before you start lowering that balance. If you’re working during school, consider using part of your income to start making payments. Even paying $50 per month to lower your balance can shorten the lifespan of the loan and save you money on interest charges.

If this is something you think can benefit you, reach out to your student loan servicer to lay out the steps to begin making payments. And if you have private student loans, reach out to your lender to see when your payments are supposed to start.

5.

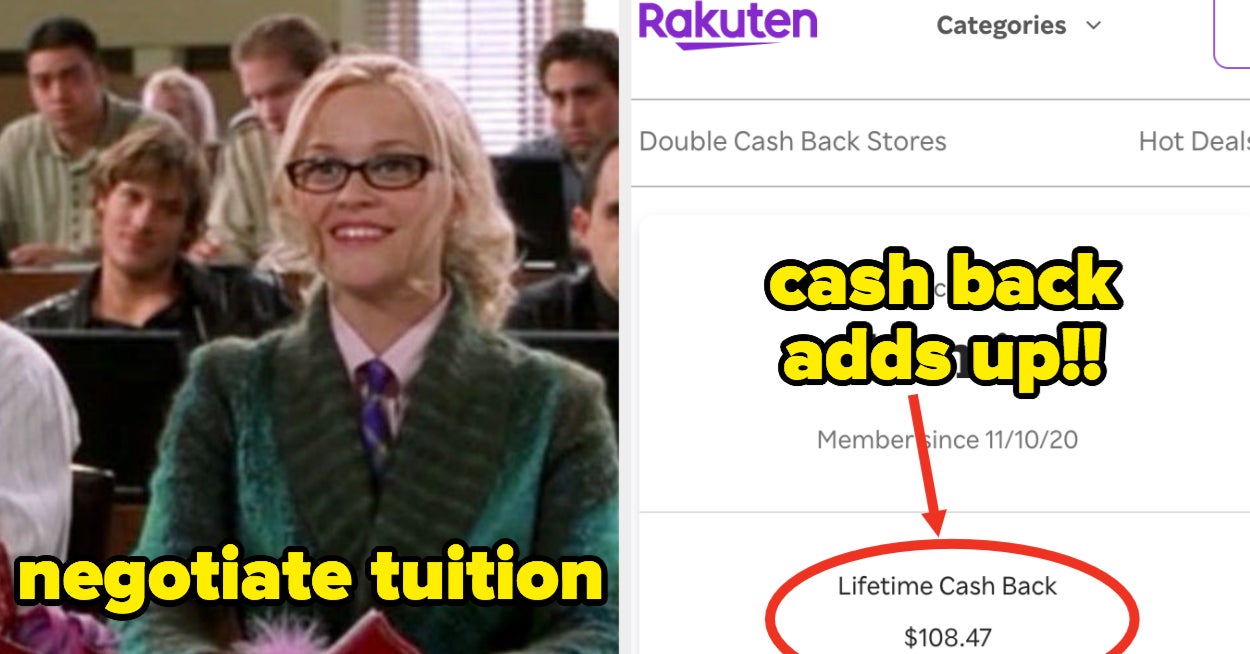

Use cash back sites like Rakuten to earn back a percentage of what you spend on a variety of daily purchases.

Jasmin Suknanan / BuzzFeed

When you’re coughing up cash for school supplies, dorm items, food, clothes, and more, you can end up spending quite a bit. So it’s actually kinda nice to see a little bit of that money back in your pocket after using Rakuten (as I can attest). Personally, it’s my favorite shopping tool since they have hundreds of brands and retailers onboard who give cash back. Some percentages can be really unimpressive (1% cash back doesn’t really seem like much!), but there’s a wealth of retailers that offer much higher returns. And, the money adds up really quickly and gets paid out to you quarterly.

6.

Instead of dorming in residence halls, consider renting off-campus with friends to save money.

Alexander Spatari / Getty Images / Via gettyimages.com

If your school’s dorms are open, living on campus can tack thousands of dollars onto your tuition bill. And when you’re attending a school that’s just too far from home, you pretty much have no other choice. But depending on your city, renting a house or apartment off campus can work out to be more affordable (especially if you’re sharing with one or more people). You can split the rent, utilities, and grocery bills.

But before you decide to go apartment hunting, it’s a good idea to work out the costs yourself. Figure out how much it will cost to live on campus (don’t forget to add in your meal plan and any other extra costs), then figure out how much it would cost rent a place nearby (also consider transportation costs for getting to and from campus).

If you do decide to live off campus, you should know that your utility payments and other bills can actually help you build a healthy credit score. You can use your payments to try to increase your FICO credit score when you sign up for Experian. Basically, the free Boost feature connects your bank account and adds your consistent, on-time bill payment history for streaming subscriptions, phone, and utility bills to your credit report, which could help bump up your score a bit. FYI, the tool won’t be able to add these payments if they’re made through checks, cash, or Venmo.

7.

Ask your college career center for discounts on business cards and professional services like LinkedIn.

The CW / Via giphy.com

Sooooo many students leave all the ~free~ perks from their campus career center on the table. Not only can your school’s career center help you with mock interviews and cover letter edits, but they also might be able to get you some discounts on a pack of business cards. Your school might even offer students a free Premium membership to LinkedIn — you just have to reach out and ask what job-boosting products and services you might be able to swing for free (or at least receive at a very attractive discount).

8.

And think about joining professional organizations related to your industry while you’re still in school — you’ll often get a significant student discount.

Type A Films / Via giphy.com

Getting involved with a professional org can be a powerful way to boost your résumé and increase your network — which can help you get a head start on finding a job after graduation. Many industries, like media, law, healthcare, and business, have professional organizations that you can join to stay up on all the latest trends and news.

They often charge membership fees, but some might offer huge discounts to students. This means you can save on your first few years of membership and still reap all the rewards, like networking and opportunities to go to workshops and conferences. Plus, many of these organizations also include their own set of perks for members (like discounts on lifestyle goods and services), so a discounted fee can really pay for itself multiple times over.

9.

Find out if your college offers tuition waivers. If you’re eligible, you might be able to negotiate lower fees or more financial aid.

CBC Television / Via giphy.com

You may or may not know this, but some colleges offer full tuition waivers to students with hardship/low-income status, Native status, adopted/fostered students, students with disabilities, and students working in the public sector. Lowering your tuition could mean taking out fewer loans to finance your education.

Be sure to ask your financial aid office if they offer such waivers! If you don’t qualify for any full tuition waivers, you can negotiate for more financial aid by reaching out to FAFSA after receiving your aid award. But you’ll never know if you don’t start by asking!

10.

And take the CLEP exam(s) to test out of (and avoid paying for) general education requirements.

The CW / Via giphy.com

The CLEP exam is a type of standardized test that pretty much lets you show college-level knowledge of general subjects so you can earn credits without taking the classes. Subject areas include business, science and math, history and social sciences, composition and literature, and foreign languages.

This can be an affordable way to cover as many general education courses as possible so you can focus your university experience around classes related to your major. And, you just might graduate a little earlier (and save money) when you don’t have to spend two semesters taking general ed classes.

But if you don’t test out of any gen ed courses, you can always take them at a community college (for a more affordable pricetag) and transfer the credits.

11.

Sign up for streaming services through your university — they’re often free to students.

20th Century Studios / Via giphy.com

When I was doing my undergrad, my school gave students free access to HBO Max. So basically, I didn’t have to pay $14.99 per month to get in on the Game of Thrones hype. Before you sign up for any streaming services, double-check to see if your school gives you free access. Also try checking for free or discounted access to Microsoft Office, Adobe Creative Cloud, and other popular services.

And even if your school doesn’t offer any freebies, you can still find great student deals out there. For example, Spotify offers a bundle for students that includes Hulu and Showtime for $4.99 a month.

12.

Look for an on-campus job that gives you free access to software and other perks.

Universal Pictures / Via giphy.com

Some part-time campus jobs might give you access to software and tools that you might also be able to use on the daily. For example, if you’re a part-time marketing assistant for a department at your school, they might give you free access to Photoshop so you can help design flyers and social media assets.

Plus, some on-campus roles might come with a few other ~perks~. For example, on many campuses, Resident Assistants (RAs) get a free meal plan and can live on campus for free. And, if you take a position at any dining halls on campus, you might be able to get some extra free cash loaded onto your meal card every semester. Depending on your university, these roles might be harder to find and may offer fewer hours than usual due to the pandemic.

13.

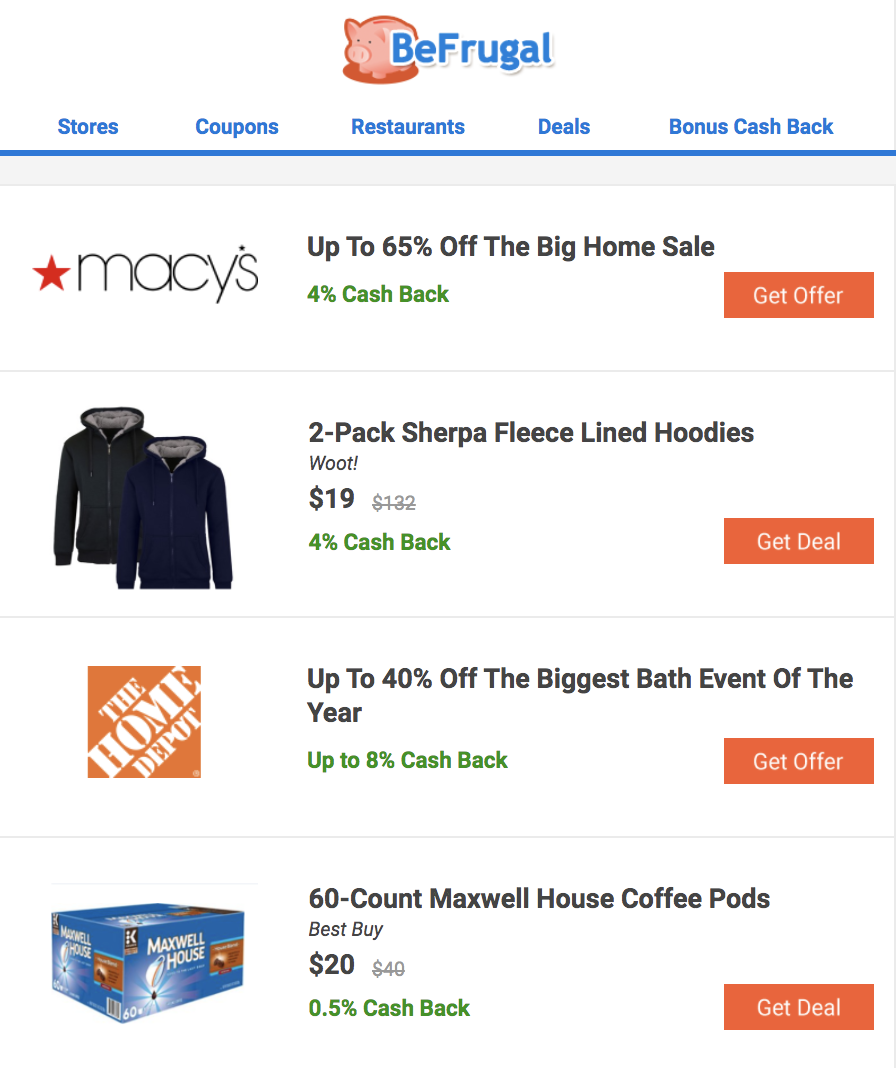

Sign up for the BeFrugal newsletter to receive weekly emails on deals for appliances, apparel, and more.

Jasmin Suknanan / BuzzFeed

As a student, you may find yourself living out of home for the first time and spending a ton of money on tech, appliances, clothing, wellness, and more. But knowing when to buy these products can help you save big. That’s where BeFrugal comes in. It’s a newsletter that sends you new discounts on a variety of items. I’ve often found cookware sets, clothing, bedding, shampoo and conditioner, shoes, and more at nearly half-price through this newsletter. It’s almost like clipping coupons, except you don’t have to spend a ton of time leafing through a bunch of circulars. BTW, BeFrugal also has a browser extension for finding cash back offers.

14.

And stay in the know about all the student discounts you can get by signing up for UniDays.

UniDays

Student discounts are lurking almost everywhere — but it can be almost impossible to track them all down! But that’s where UniDays comes in handy. It’s basically a hub featuring student discounts from brands, retailers, and services. Think Hulu, Adobe, Apple Music, HelloFresh, Zipcar, and more. They include brands across lifestyle, beauty, fashion, food, technology, sports, and media —you’ll just need your university email address to sign up.

15.

If you live on campus, avoid buying too many extra groceries, just in case you don’t end up cooking in your dorm as often as you plan to.

D3sign / Getty Images / Via gettyimages.com

One huge mistake I made as a student living on campus with a meal plan was constantly buying extra food to keep in my fridge. I loved cooking at home and thought that I’d love cooking one or two times a week at school, but this didn’t turn out to be the case. I was often too tired or too busy to gather all my ingredients and go down to the communal kitchen to make a full meal. It was usually easier to just buy food from the dining hall. I overestimated how often I’d cook meals at school and as a result, my groceries went bad quickly.

Of course, having some extra food on hand can be a good idea. For example, cans of your favorite soup or hearty microwaveable meals can help you avoid going out for food when you really don’t feel like it, or when your meal card balance is running low. You just have to strike the right personal balance, and avoid buying produce and other perishables that you won’t realistically use up in a short amount of time.

16.

Avoid taking out loans for anything unrelated to your education.

Halfpoint Images / Getty Images / Via gettyimages.com

Some people take out additional loans for other lifestyle expenses — like furnishing an off-campus apartment or purchasing technology for school. While it may feel like you won’t have to deal with loan repayment for a loooong time, they can really sneak up on you once you graduate and you face being charged interest. So to limit the amount of debt you go into, avoid borrowing money for purchases that aren’t directly related to school. Find another way to finance that couch you really want for your apartment, or spring for that laptop when it goes on sale.

17.

Negotiate a lower price for your Wi-Fi bill if you’re learning remotely.

Portra / Getty Images / Via gettyimages.com

Since the pandemic hit, being able to get online is more important than ever. You need it to connect to your live Zoom classes, turn in online assignments, use your school’s online class portal, and more. But that doesn’t mean your Wi-Fi costs have to burn a hole in your wallet! Call up your internet service provider to try to negotiate a lower monthly bill. Prior to calling, do a little research to see the rates from competitors so you know what would be a reasonable ask. You might even find that your provider has some special deals for students, so it’s a good idea to ask about those too. Besides, service providers don’t want to risk losing a customer, so they might be willing to have a conversation with you about your bill.

18.

Finally, claim your tuition tax credit if you’re a student paying your own way through college.

NBC / Via giphy.com

Thanks to the American Opportunity Tax Credit (AOTC), you miiiight qualify to claim a tax credit to receive up to $2,500 off the cost of tuition. The IRS has a comprehensive guide on this credit opportunity, but in order to be eligible, you must be at least a part-time student at a recognized university who hasn’t claimed the tax credit for more than four tax years. Your income must also be below $80,000 if you’re single (or below $160,000 if you’re married) to receive the full credit amount (though you can receive a partial amount if your income is above $80,000 but below $90,000).

Sure, it’s not like you’ll be able to receive a massive tuition refund, but $2,500 is still better than nothing!

Now I’m curious, what’s helped you save money as a student? Share your tips and tricks in the comments below!

And if this sounds like music to your ears (and bank account), check out more of our personal finance posts.

[ad_2]

Source link